Analysis of the effect of health insurance on health care utilization in Rwanda: a secondary data analysis of Rwanda integrated living condition survey 2016-2017 (EICV 5)

Roger Muremyi, Haughton Dominique, Francois Niragire, Kabano Ignace, Sandrine Abayisenga

Corresponding author: Roger Muremyi, African Centre of Excellence in Data Science and Lecturer in the Department of Applied Statistics, University of Rwanda, Kigali, Rwanda

Received: 29 Jul 2020 - Accepted: 29 Nov 2020 - Published: 12 Feb 2021

Domain: Community health,Health policy,Health Research

Keywords: Health, insurance, care, utilization, services, Rwanda

©Roger Muremyi et al. PAMJ-One Health (ISSN: 2707-2800). This is an Open Access article distributed under the terms of the Creative Commons Attribution International 4.0 License (https://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Cite this article: Roger Muremyi et al. Analysis of the effect of health insurance on health care utilization in Rwanda: a secondary data analysis of Rwanda integrated living condition survey 2016-2017 (EICV 5). PAMJ-One Health. 2021;4:10. [doi: 10.11604/pamj-oh.2021.4.10.25256]

Available online at: https://www.one-health.panafrican-med-journal.com/content/article/4/10/full

Research

Analysis of the effect of health insurance on health care utilization in Rwanda: a secondary data analysis of Rwanda integrated living condition survey 2016-2017 (EICV 5)

This article has been retracted

This article was retracted on 18 May 2021. See PAMJ Retraction Policy

See retraction here Pan

African Medical Journal. 2021;4:10 | 10.11604/pamj.2021.5.8.29814

Analysis of the effect of health insurance on health care utilization in Rwanda: a secondary data analysis of Rwanda integrated living condition survey 2016-2017 (EICV 5)

Roger Muremyi1,&, Haughton Dominique2, Francois Niragire3, Kabano Ignace4, Sandrine Abayisenga5

&Corresponding author

Introduction: health insurance is an insurance policy that guaranteed that you receive cashless therapy or reimbursement of expenses in case you become ill. Rwanda has made extensive positive aspects in the health and welfare of its population over a fairly quick period of time, along with standout achievement of Millennium Development Goals (MDGs). However, today health insurance has expanded compared to previous years, with this success health services become more accessible. Despite a high rate of enrollment of health insurance in Rwanda, the universal health coverage is not yet achieved. In addition to this, little has been done to analyze the effect of health insurance on health care utilization.

Methods: this is a secondary data analysis from Rwanda integrated living condition survey 2016-2017, the survey gathered data from 14580 households and 64314 individuals and we analyzed this data through summary statistics as well as logistic regression model.

Results: as we focused on mutual health insurance in analysis, our statistical modeling indicates that mutual health insurance (MHI) is related with significantly increased health care utilization when they are needed. In addition to that of one household in third quintile increase 78% on health care utilization. However, the same as adding one household in fourth quintile increase 81% on getting medical consultation and one unit of quintile5 increases 0.0119% on medical utilization. Not only that also adding one person in eastern province increases the use of health services by 22%; and adding one person in western province increases the use of health service by 24% one person in southern province increases the use of health services by 70%; differ from adding one individual in northern province because this reduce use of health service by 0.00084% and one household with MHI increase use of health service by 22%. As expected, individuals in households with MHI used health services (23.67%) twice as lots as those in households with no insurance coverage (11.61%). In spite of that, the boundaries of the Mutual Health Insurance coverage also become understood and these results show that expansion of MHI will certainly be beneficial to improving health access.

Conclusion: from our results we are confidently say that health insurance has had strong positive effect on health care utilization in Rwanda and can continue to enhance Rwandan´s health even more if its limitations are also resolved. Finally, we can conclude that the findings from our research will guide policymaker and provide useful insights within the Rwandan context as well as for other countries that are considering moving towards universal coverage through similar models.

Access to health care is an important determinant in assessing equity in health care utilization. However, in developing countries, health care utilization is not influenced only by demand constraint but also supply constraints which is determined solely by the ability to pay rather than need for care [1,2]. Moreover, this situation can impose heavy financial burdens on individuals as well as households and in certain instance can impoverish them or lead to financial catastrophe [3]. Finally, inequities in health care utilization have been documented, those who need health care utilization are not receiving what might be considered a fair share of benefits [4,5]. In Rwanda, it was in the 1960 that community-based health insurance systems, like the association Muvandimwe de Kibungo (1966) and the association Umubano mubantu de Butare (1975) started to be constituted [6,7]. However, these community-based health insurance initiatives were further developed only since the reintroduction of the payment policy in 1996 [6,7]. The development of community-based health insurance initiatives in the form of modern mutual health insurance has been on the increase during the past five years [7,8,9]. In fact, the number of mutual health insurance increased from six (6) in 1998 to 76 in 2001 and 226 in November 2004. Moreover, the geographical coverage of mutual health insurance was also extended: whereas initially in 1999, these mutual health insurances were mainly developed in the four provinces of the country, they have since August 2004, been established in virtually all the eleven provinces of the country, as well as in the city hall of Kigali [8].

Up on independence in 1952, Rwanda inherited a free of charge health care policy which revealed later on the unrealistic, ineffective and unsustainable. It was therefore abandoned. Apart from insurance for occupational disease and injuries covered by Caisse Social du Rwanda (CSR) for formal sector employees, the abandonment of the system created a total vacuum, leaving the entire population exposed to diverse risk related to health without any insurance coverage [10,11]. However, this situation has changed dramatically with the emergence and extension of Community Based Health Insurance (CBHI) system [12]. At the end of 2008, Rwanda has achieved impressive health insurance coverage of 92% of its population [13]. In addition to this, the national Community Based Health Insurance coverage rate was estimated at 85%, with other insurance schemes covering an estimated 4% of the population [13]. Therefore, universal access to equitable and affordable quality health services for all Rwandans is the overall aim of the Government of Rwanda´s (GoR) Health Sector Policy [14]. The priorities set forth in the Health Sector Policy are based on the development goals laid out in the Economic Development and Poverty Reduction Strategy and Rwanda´s Vision 2020 [15]. The Mutuelles de Santé/Community-Based Health Insurance (CBHI) scheme was developed to meet the needs of Rwandans outside of the formal sector, where access to and utilization of healthcare services had been historically very low [15]. Beginning with pilots in 1999, and established as national policy in 2004, Rwanda quickly scaled Community-Based Health Insurance (CBHI) across the country. Membership grew to 91% of the target population by 2010-11 [16]. Enrollment decreased in recent years, with a June 2015 estimate of 75% coverage, among those eligible for the scheme [16]. The scheme features included strong public financial support to allow the informal sector population access to the essential health care package. Nowadays in Rwanda, health care insurance is very successful because of high effort they put on it. The new system was implemented, where people paying their contributions following their income and their financial capacity and this new system use data from UBUDEHE category [17]. Finally, the category one had their contribution paid by government, the category two and third they pay 3000frws and the fourth category pay 7000frws. As the results, this policy increased the potential of mutual health insurance, so that the majority of the population of Rwanda could benefit from it [18].

Over the years, Rwanda has seen an important increase in its expenditure on total health expenditure (THE) per capita increasing from US$ 34 in 2006 to 840 in 2014 [19]. Public sources accounted for the majority of total health expenditure, households contributed for 26% of total health expenditure trough out of pocket health expenditure (OOP) [19]. In its efforts to improve access, the country has developed a comprehensive health sector strategic plan [19,20]. A major focus of this plan is the expansion of health insurance to the informal sector through Mutual Health Insurance [20]. Building on the experience of earlier pilots, the government supported start-up initiatives and over Mutual Health Insurance schemes were created between 2000 and 2003 [19,20]. Moreover, population coverage increased continuously during this period and was estimated to have 51.5% in 2004 [20]. Mutual Health Insurance (MHI) was further scaled up in 2005 with the support of external funding [21]. The aim of this expansion was to rapidly increase membership of vulnerable groups through premium subsidies and strengthen administrative capacities and pooling mechanisms [22]. By 2007, around 74% of the population had some form of health insurance cover. Furthermore, in 2008, a formal legal framework for Mutual Health Insurance was created with the adoption of law on mutual health insurance [23] and this set a new milestone towards universal coverage by making health insurance compulsory. Even though there are facilitation to get health care utilization on those who have health insurance in Rwanda, there are still problem for some people who didn´t get all contribution at the same time. This is the big problem because for example you have family of nine persons, and you are in second ubudehe category [23]. If you pay the contribution of seven persons, those two remain you are supposed to get treatment as insurer when all family members be paid the mutually insurance [23]. This so bad because once you get ill or one of your family get ill, you can´t receive health care utilization as insurer you are supposed to get medical treatment by paying 100% as private one, unless all family member have paid their contribution. And this cause mal-treatment in hospital [23]. The health care utilization can be explained using the Anderson Model which divides the factors that influence utilization into three main categories [23,24]. First, the predisposing factors which consist of inherent factors that exist within individuals [24]. Examples are age, gender and education level and economic activity [24]. Second, the enabling factors which are family means to obtain health care utilization.

In Malaysia, after analyzing the effect of health insurance on health care utilization, the result shows that health insurance ownership is significant in determining access but has no influence on subsequent use [24]. The fact that health insurance ownership influence access to care provides evidence for the needs to promote health insurance ownership either private or public to ensure better access to care for all individuals [24]. More importantly, the findings show no evidence of moral hazard as health insurance ownership does not influence the intensity of health care use. In addition, as the model assumes that the subsequent health care visits are related to the same illnesses, then the findings also suggest that there is no evidence of moral hazard by the medical providers. In Japan, they estimated the impact of massive expansion of health insurance program on health care utilization and health outcomes and their findings showed a substantial increases in health care utilization, which are much larger than what would be implied by the individual-level effect estimated by Manning et al. (1987) and Newhouse (1993) [24]. In Rwanda, the research conducted by (Ruhara et al. 2016) on the role of economic factors in the choice of medical providers indicated that health insurance is an important factor in the choice of health facilities and the user fees are major financial barriers to health care access in Rwanda. Finally, their results suggest that as household income increases, patients shift from public to private health facilities where quality is assumed to be higher than public health providers [22]. This study looked at the health insurance´s effect on health care utilization.

In this study the secondary data were collected from NISR drowned from integrated living conditions survey 2016-2017 (EICV 5) [24]. This nationally representative survey gathered data from 14580 households and 64314 individuals. Information was collected at the household and the individual level. Household level information included consumption expenditure on food, non-food items and out-of-pocket health expenditures including: consultation; laboratory tests; hospitalization; and medication costs. Individual level information included socio-economic indicators and insurance status, self-reported health need and utilization of services. We explored the relationship between health insurance and utilization of health care among the insured and non-insured population. However, health insurance coverage was modeled as the household head´s coverage. The quintile variable was defined in the basis of household expenditure and the extracted variables includes: age, sex, whether the household head had completed primary education, households size, household expenditure quintile, region, household insurance status and interaction of household insurance with expenditure quintile.

Education level of household head: this is an Independent variable measured by level of education attainment. The higher the education level of education of household head has the better will be understood concerning the knowledge of health care utilization. Thus, educational level is assumed to have positive association with dependent variable.

Household size: the number of family members residing with the respondent. The larger the family size members, the more utilization health care increased it is easy to protect the family of 3 members than family with 10 members. Therefore, there is a possibility of having enough money to be capable of protecting family member to get some illness such as diarrhea, Malaria, this it is hypothesized to have association with the dependent variable. However, this variable may have a negative impact on the healthcare utilization in case the family is dependent which may result into lack of money to get health care services because they get sick more and have not enough money to buy medicine. This led the variable to effect both positive and negative on health care utilization.

Age of individual: it is defined as the number of years of the respondent individual since birth until year the survey was conducted. It is a continuous variable measured by years. This variable on dependent has positive and negative impact. There are some ages affect positively health care utilization and the ages affect negatively health insurance utilization.

Sex of respondent: sex of individual is another independent factor which can affect the utilization of health care. It is known that most of the women are more likely to use health care than men.

Region (province): this determines the residence of household when they conduct survey. We have five province Kigali City, Eastern province, Western province, Northern Province and Southern province.

Household health insurance status: this independent variable is determined by the Mutual Health Insurance (MHI), Rwandaise d´Assurance Maladie (RAMA), Military Medical Insurance (MMI), employer, other Insurance and no insurance. These are the household health insurance we had on our study.

Household expenditure quintile: a quintile is a statistical value of a data set that represents 20% of a given population, so the first quintile represents the lowest fifth of the data (1% to 20%); the second quintile represents the second fifth (21% to 40%), the third quintile represents the third fifth (41% to 60%); the fourth quintile represents the fourth fifth (61% to 80%); and the fifth quintile represent the highest fifth of the data (81% to 100%), [24].

Health insurance: is an insurance policy that guaranteed that you receive cashless therapy or reimbursement of expenses in case you become ill. However, a health insurance policy reimburses the insured for medical and surgical expenses resulting from a disease or injury that leads to hospitalization. Health insurance may decrease out-of-pocket medical spending [24]. Health insurance, which is coverage against risk incurring medical and related financial costs, is one of the ways that people in various countries finance their medical needs. In every country, there are people who are unable to pay directly or out of pocket for the healthcare services they need, or financially they may be seriously disadvantaged by doing so. In lower-income countries, many forms of health insurance- whether public or private-cover only minimum set of services, such that they do not provide full financial risk protection. The World Health Organization (WHO) estimates that out-pocket expenditure of over 15-20% of total health expenditure or 40% of household net income of subsistence needs can lead to financial catastrophe [24].

When people on low incomes with no financial risk protection fall ill, they face a dilemma: they can use health services (if available) and suffer further impoverishment in paying them, or they can forego services, remain ill, and risk being unable to work or function [24]. In Rwanda, micro health insurance schemes such as community-based health insurance (CBHI) have been established as nonprofit financing mechanism to benefit the poor [24]. CBHI is usually based on voluntary membership, whereby a member is linked to a health care provide. However, it is based on ethic of mutual aid whereby members who are susceptible to risk out together their resources and contribute into mutual health organizations, medical aid societies, and micro-insurance scheme [24]. While CBHI improves resource mobilization for health and health service utilization and protection for financial risk, it is vulnerable to adverse selection, where disproportionate enrollment by high-risk contributors accompanies nonparticipation by low-risk individuals [25].

Health care: is a general term comprising services provided to improve health in the general population as well as to cure diseases and relieve symptoms in diseased patients. Health care may denote the organization of services (e.g. private vs public health care), a facility (e.g. hospital or health care center), as well as the actual delivery of care (e.g. to provide health care or to obtain health care). However, the term may comprise preventive services, such as vaccination, and mother and child care as well as curative services [25]. Rwanda follows a universal health care model, which provides health insurance through a system called Mutuelles des santé. The system is community-based health insurance scheme, in which residents of a particular area pay premiums into local health fund, and can draw it from it when need of medical care [26].

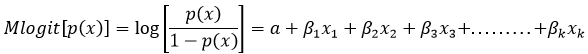

Health care utilization: is the quantification or description of the use of services by persons for the purpose of preventing and curing health problems, promoting maintenance of health and well-being, or obtaining information about one´s health status and prognosis [27]. Logistic regression model.

Interpretation of Model

Logit (use of health service)=0.20 female+0.152 head with primary education+1.094 under 5 years-0.260 over 65 years+0.018 household size+0.501 quintile2+0.786 quintile3+0.813 quintile4+1.190 quintile5+0.222 eastern province+0.244 western province+0.701 southern province-0.084 northern province+2.08 MHI. Adding one female increase attending medical consultation by 20%, added of one head of household with primary education increase use of health services by 15%; the same as new born child till 4 years this increases use of health services by 0.019%. However, differ from adding one person with 65 years and over this reduce the health care utilization by 26%. adding one person on household this increase medical consultation by 0.00018%; when one household fall in quintile 2, tend to increase medical utilization by 0.005% and addition of one household in third quintile increase 78% on health care utilization. The same as adding one household in fourth quintile increase 81% on getting medical consultation. And one unit of quintile 5 increases 0.0119% on medical utilization. Not only that because adding one person in eastern province increase use of health services by 22%; the same as adding one person in western province increase use of health service by 24% one person in southern province increase use of health services by 70%; differ from adding one individual in northern province because this reduce use of health service by 0.00084% and one household with MHI increase use of health service by 2.08. As the calculated chi-square statistics is highly significant at 5%, then the null hypothesis that against model´s correct is rejected. This means that the probability in the upper tail beyond the calculated statistics is smaller than the significance level chosen for test. Hence our explanatory variables are important covariates to the model.

As it is shown in the Table 1, the high proportion of individual under this study was female with 52.14% and 47.86% of male. Reference made to the findings from Table 2, with respect to the location of the respondents, among 64314 respondents, Kigali has 10.12%, Southern province 23.70%, Western province has 21.35%; Northern province has 14.09%; and Eastern province has 21.38%, and it shows that many respondents were from southern province with 23.70%. As it is indicated in the Table 3 highest health insurance status of respondents was seen in the Mutual health insurance about 69.50% of all respondents. The findings from Table 4 shows that respondents expenditure quintile, 20.40% are in lowest firth of the data (1% to 20%); 20.16% in the second quintile (21% to 40%); 19.92% are in third quintile (41% to 60%); 19.76% are in fourth quintile (61% to 80%); and 19.76% are in fifth quintile (81% to 100%). Finally, this implies that the half of respondents were in the first, second and third expenditure quintile.

As shown in Table 5 more households were more likely to be enrolled in MHI. Comparatively, other insurance schemes, including RAMA with 3.09%, MMI with 0.81%, employer with 0.14%; other insurance 0.58% and those with no health insurance with 25.88%. As it is shown in the Table 6, the people suffer from health problems in fifth quintile were few compared with those in the fourth, third, second, and first. But after all result shows that, the households in fifth quintile were get medical consultation than the others. The household with no health insurance are more likely to have health problems and they are the one who do not get medical consultation. Means that, whenever they get sick it is hard for them to pay medical expenses without health insurance; but those with MHI insurance were significantly more likely to get medical consultation than the non-insured people. As it is shown in Table 7, the people suffer from health problems in fifth quintile were few compared with those in the fourth, third, second, and first. The results from logistic regression analysis is shown in the Table 7 and it shows that, sex of households, education of head of household (primary completed), age of households, household expenditure quintile, province, and Mutual Health Insurance are statistically significant because the overall result the p-value is less than 0.05. Finally, all mentioned variables have an influence on health care utilization. The finding of this study showed that the effect of health insurance was further examined via performing a logistic regression on the use of health services through individuals within the population eligible for mutual health insurance coverage who said they get medical consultation in the preceding four weeks.

Education attainment has an expected sign and is statistically significant. The education increases the use of health services. The result shows that the head of household with primary education increases odds by 0.152 in health care utilization. However, sex is statistically significant to health care utilization. With our findings, female have a major respondent suffer from any health problem and getting medical consultation. The reproductive age female need more medical service than men and this cause them to be more likely to use health care. The findings shows that age of households has increase and reduce health care utilization and it is statistically significant. In result, the households with under 5 years has increase health care utilization and those with 65 years and over has reduced health care utilization. The under five years need more medical consultation. The pattern of health care utilization was also different among the insured and non-insured, as well between the poor and rich. However, MHI is associated with higher utilization. Indeed, MHI insured individuals who needed services were more likely to use services irrespective of wealth. In fact, Health insurance has a higher effect on health care utilization in lower quintile than the highest quintile. The characteristics suggest that the MHI system in Rwanda will inherently decrease the existing utilization gap between the poor and the rich. These results show that expansion of MHI will certainly be beneficial to improving access.

The findings from this study provide evidence that the use of healthcare services is much higher in western and southern provinces, individuals with health insurance in third and fourth quintiles are accessing health care services when they are in need than other individuals and mutual health insurance is significantly contributing to the reduction of out-of-pocket expenditures for healthcare in public health facilities. Finally, efforts should therefore be put in place to ensure that all individuals in all quintiles access equal and affordable health care services in case they are in need and this will help the government of Rwanda to achieve the universal health coverage as it is set in its strategic goals of the sustainable development goals.

What is known about this topic

- In general, challenges facing MHI since its first introduction in 1999/2000 to present were gradually known but few research were focused on effect of health insurance on health care utilization in Rwanda;

- Some households still claiming about their money saying that they never get sick, how can they pay health insurance.

What this study adds

- Health insurance is best way of getting health care service without any hardship, if you don´t have any it is better to find it as soon as possible because it will reduce the out of pocket expenditures on healthcare services and you pay every time you receive medical treatment;

- Universal Health Coverage will be achieved if all households have health insurance and no households under poverty line.

The authors declare no competing interests.

Roger Muremyi contributed to the design of the manuscript, data analysis and interpretation of the results; Dominique Haughton contributed in the revision of the methodology used in the data analysis and guidance in writing this manuscript; Niragire Francois provide the hints of how to write a publishable paper in peer review journals by providing the guidance and made substantial revision to the initial draft, Kabano Ignace contributed in the format and grammatical analysis; Sandrine Abayisenga contributed to the selection of the topic with guidance of Roger Muremyi. All the authors have read and agreed to the final manuscript

Table 1: is indicating the proportion of the sex types of respondents

Table 2: shows the proportion of the respondent according to their residence regions of the respondents

Table 3: proportion of the respondents with respect to the main health insurance status used by households

Table 4: is showing the proportion of the respondents according to the richest level by expenditure quintile

Table 5: indicating the proportion of the health insurance coverage of households by quintile

Table 6: this table shows the percentages individuals who suffer from any health problem and medical consultation in last 4 weeks by quintile and health insurance status

Table 7: this table shows a logistic regression results for use of health services for the defined population

- African strategies for health: health insurance profile. Rwanda. 2016.

- Aimable Twahirwa. Sharing the burden of sickness: mutual health insurance in Rwanda. Bull World Health Organ. 2008 Nov;86(11):823-4. PubMed | Google Scholar

- Ataguba JE, McIntyre D. Paying for and receiving benefits from health services in South Africa: is the health system equitable. Health Policy Plan. 2012 Mar;27 Suppl 1:i35-45. PubMed | Google Scholar

- Andersen R. Revisiting the behavioral model and access to care: does it matter. Journal of health and social behavior. 1995 Mar;36(1):1-10. PubMed

- Arpah Abu-Bakara SS. The effect of health insurance on health care utilization: evidence from Malaysia. European Proceedings of Social and Behavioural Sciences. 2016;366-367. Google Scholar

- Bounkham Vieng. The prospect of universal health coverage and equity access to health care services in Lao PDR. Cinii. 2017. Google Scholar

- Cheng SH, Chiang TL. Disparity of medical care utilization among different health insurance schemes in Taiwan. Social Science Medicine. Soc Sci Med. 1998 Sep;47(5):613-20. PubMed | Google Scholar

- Grossman M. On the concept of health capital and the demand for health. Journal of Political Economy. 1972;80(2). PubMed | Google Scholar

- Gujarati DN, Porter DC. Essentials of econometrics (McGraw-Hil International Editions) (second edition). 1999. Google Scholar

- FS. Health insurance profile: Rwanda. 2016. Google Scholar

- MOH. Rwanda national health insurance polcy. MOH. 2010.

- MS. Rwanda improves access to care and equity through community-based health insurance. 2016.

- Hidayat B, Pokhrel S. The selection of an appropriate count data model for modelling health insurance and health care demand: case of Indonesia. Int J Environ Res Public Health. 2010 Jan;7(1):9-27. PubMed | Google Scholar

- Odeyemi IAO. Community-based health insurance programmes and the national health insurance scheme of Nigeria: challenges to uptake and integration. International Journal for Equity in Health. 2014;13:20. PubMed | Google Scholar

- Hopkins K. Basic statistcs for the Behavioral Sciences. 1996. Google Scholar

- John Ele-Ojo Atagubaa, Jane Goudgeb. The impact of health insurance on health-care utilisation and out-of-pocket payments in South Africa. The Geneva Papers on Risk and Insurance. 2012. Google Scholar

- Manning WG. Health insurance and the demand for medical care: evidence from a randomized experiment; American Economic Review. Am Econ Rev. 1987 Jun;77(3):251-77. PubMed | Google Scholar

- Maximillian Kolbe Domapielle. Health insurance and access to health care services in developing countries. Indonesian Journal of Government and Politics. 2014. Google Scholar

- Michael Anderson, Carlos Dobkin, Tal Gross. The effect of health insurance coverage on the use of medical service. American Economic Journal. 2012;4(1). Google Scholar

- MOH. Mutual health insurance policy in Rwanda. 2004. Google Scholar

- RSSB. Rwanda national health insurance policy. 2019. Google Scholar

- Ruhara Mulindabigwi Charles, Urbanus Mutuku Kioko. Effect of Health Insurance on demand for outpatient medical care in Rwanda: an application of the control function approach. Rwanda Journal. 2016. Google Scholar

- Priyanka Saksena, Adélio Fernandes Antunes, Ke Xu, Laurent Musango, Guy Carrin. Impact of mutual health insurance on access to health care and financial risk protection in Rwanda World Health Report. World Health Organization. 2010. Google Scholar

- WHO. World Health Organization statistical information system: core health indicators. 2006. Google Scholar

- Sabrina Jiang, James, David Kindness. Quintiles. investopedia. 2020.

- Médard Nyandekwe, Manassé Nzayirambaho, Jean Baptiste Kakoma. Universal health insurance in Rwanda: major challenges and solutions for financial sustainability case study of Rwanda community-based health insurance part I. The Pan African Medical. 2020;37:55. PubMed | Google Scholar

- Roger Muremyi, Haughton Dominique, Kabano Ignace, Francois Niragire. Prediction of out-of-pocket health expenditures in Rwanda using machine learning techniques. The Pan African Medical. 2020;37:357. Google Scholar